This page is part of the CARIN Digital Insurance Card (v1.1.0: STU1) based on FHIR (HL7® FHIR® Standard) R4. This is the current published version in its permanent home (it will always be available at this URL). For a full list of available versions, see the Directory of published versions

| Term | Definition |

| Subscriber | An individual or entity that selects benefits offered by an entity, such as an employer, government, or insurance company |

| Dependent | An individual, other than the subscriber, who has insurance coverage under the benefits selected by a subscriber |

| Member | Any individual covered by the benefits offered by an entity, such as an employer or insurance company. In the US, some government programs refer to Members as Beneficiaries. |

| Patient |

An individual who has received, is receiving or intends to receive health care services. (Health care services as defined by federal and state regulations.) |

| Personal Representative | Per the HIPAA privacy regulations at 45 CFR 164.502(g), a personal-representative is someone authorized under state or other applicable law to act on behalf of the individual in making health care related decisions (such as a parent, guardian, or person with a medical power of attorney) |

| Payer |

Public or private party which offers and/or administers health insurance plan(s) or coverage and/or pays claims directly or indirectly. Examples include:

|

This implementation guide is designed to standardize the way that health insurance companies provide the data elements found on the physical insurance card in a FHIR-based API exchange. The primary use case is to support insurance members (or their personal representatives) who wish to retrieve their current proof of insurance coverage digitally via a consumer-facing application. This will provide an alternative to using the physical insurance card as proof of insurance.

When an individual visits a healthcare provider, they may be asked to provide proof of insurance prior to receiving care. Instead of relying on their physical insurance card, the individual may pull out their phone and open a digital application to display their insurance card information. This will assist in cases of a lost or forgotten physical insurance card. The provider can capture the necessary information for proof of insurance based on the information displayed in the consumer-facing application.

Consumer-directed exchange occurs when a consumer or an authorized caregiver invokes their HIPAA Individual Right of Access (45 CFR 164.524) and requests their digital health information from a HIPAA covered entity (CE) via an application or other third-party data steward.

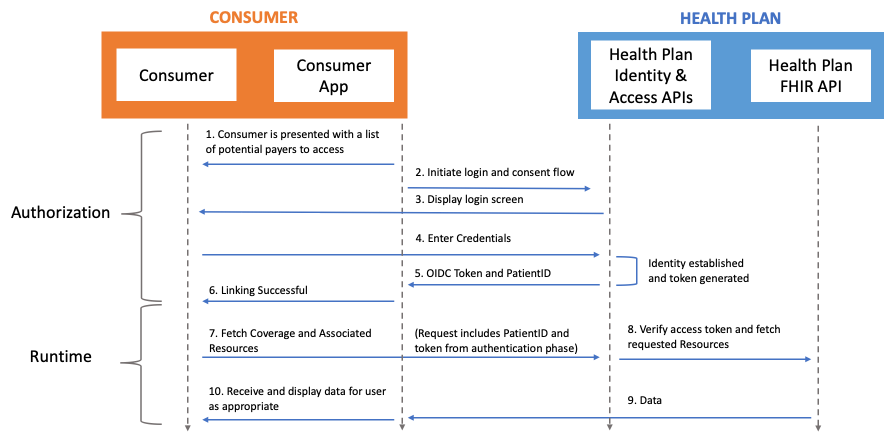

Precondition: Consumer App registers with a payer endpoint and receives a client ID and client secret

Actors:

Actors:

Flow:

The Digital Insurance Card can also be made available to the member in a verifiable, tamper-proof package that the subscriber can store, manage, and share with healthcare providers as they see fit. In this model, the payer provides the member with a QR code or URL representing their digital insurance card, likely using the same modalities used to share digital cards today (e.g. payer mobile application, website, email). The member is able to present the QR code to be scanned during in-person visits or provide the QR code or URL to mobile or web forms during online registration or check-in flows. The provider then uses the QR code or URL to retrieve the Digital Insurance Card and verify its authenticity.

[SMART Health Cards](https://spec.smarthealth.cards/) are a FHIR-based verifiable credential technical framework that has been made available to hundreds of millions of people around the world for proof of vaccination and infectious disease laboratory testing results.

[SMART Health Links](https://docs.smarthealthit.org/smart-health-links/design) are a derivation of SMART Health Cards that enable larger and dynamic data payloads as well as other methods of interaction.

Flow: